Quick Glossary

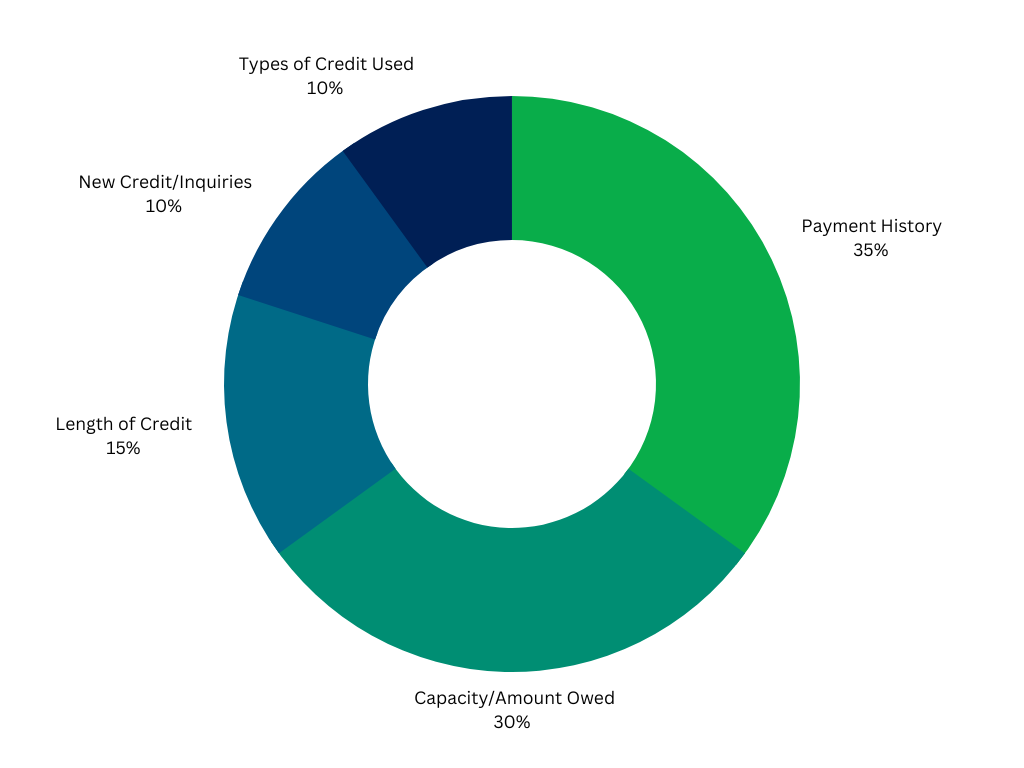

A credit score is a number generated by a mathematical formula that is meant to predict creditworthiness. Credit scores range from 300-850. The higher your score is, the more likely you are to get a loan. The lower your score is, the less likely you are to get a loan. If you have a low credit score and manage to get approved for credit, your interest rate will be much higher than someone who had a good credit score. So, having a high credit score will save you many thousands of dollars.

A credit bureau is a company that collects and maintains your credit information and sells it to lenders, creditors and consumers in the form of a credit report. There are dozens of credit bureaus, we're most concerned with the big three: Equifax, Experian, and TransUnion. Each company is a multi-billion dollar company that profits from your information. They are NOT government agencies.

A credit report provides an overview of your credit as potential lenders see it today. It lists the items that are negatively and positively affecting your score and a short explanation of what the item is. Credit Reports are from each of the 3 bureaus as well as your FICO report.